In today’s fast-paced digital world, financial security has become a serious concern for individuals and businesses alike. With online scams, identity theft, and unauthorized transactions on the rise, people are increasingly searching for reliable solutions to safeguard their money. Traditional credit and debit cards are convenient, but they are also vulnerable to fraud. This is where Cardian – The SafeCard comes into the picture.

Cardian SafeCard is a modern innovation designed to offer people peace of mind while using their bank cards. Whether you shop online or swipe your card at local stores, SafeCard promises to enhance security, reduce risks, and prevent unauthorized usage. But does it really live up to the claims? In this detailed article, we will explore every aspect of Cardian SafeCard, including how it works, its features, benefits, pricing, customer reviews, and whether it’s worth buying.

What is Cardian – The SafeCard?

Cardian SafeCard is a smart protective card system created to block fraudulent activities and shield your personal financial information from hackers, scammers, and unauthorized users. Unlike traditional credit or debit cards that simply rely on a PIN or a signature for verification, SafeCard uses cutting-edge security layers to provide extra protection.

Think of it as a guardian for your wallet. You can store your debit card, credit card, or bank card information with SafeCard and rely on its features to prevent misuse. Many versions of SafeCard also come with RFID blocking technology, ensuring that cybercriminals can’t skim your data by scanning your card remotely.

Why Do We Need Products Like Cardian SafeCard?

Fraud cases are growing worldwide, and many people underestimate how easy it is for hackers to access card details. Here are some concerning statistics that explain why products like SafeCard are becoming essential:

- Identity theft and fraud are among the fastest-growing crimes globally.

- Millions of people fall victim to unauthorized transactions every year.

- Contactless payment systems have made shopping easier but also left consumers vulnerable to RFID skimming attacks.

- Traditional cards do not always provide real-time fraud prevention, leaving users helpless until they notice the suspicious transaction.

With such risks, SafeCard provides an extra wall of defense that protects users beyond what banks or credit card companies typically offer.

How Does Cardian SafeCard Work?

Cardian SafeCard is not just another physical card cover—it is a smart protective system. Depending on the model, it typically works in the following ways:

- RFID Blocking Technology

Many SafeCard models are equipped with RFID (Radio Frequency Identification) blocking. This prevents hackers from using skimming devices to steal card information when your card is inside your wallet. - PIN or Biometric Protection

Advanced versions require a PIN code or fingerprint authentication before the card can be used. This means that even if your physical card is stolen, no one can make transactions without your approval. - App Connectivity

Some versions connect with a mobile app where users can manage card usage, set spending limits, and receive real-time alerts about suspicious activities. - On/Off Feature

SafeCard allows you to lock or unlock your card instantly, giving you complete control. If you lose your card, you can disable it within seconds, preventing misuse.

Key Features of Cardian – The SafeCard

- Anti-Skimming Technology

Prevents criminals from scanning your card using RFID skimmers. - PIN & Biometric Security

Only the authorized owner can activate the card for payments. - Smart App Integration

Receive alerts, track spending, and control your card from your smartphone. - Universal Compatibility

Works with debit cards, credit cards, and other banking cards. - Lightweight & Portable

Designed like a regular card, it fits easily into wallets and purses. - Durable Build

Made from strong materials to withstand everyday usage. - Instant Card Lock

Lets you disable your card immediately in case of theft or loss. - Travel-Friendly

Provides added peace of mind when traveling abroad, where fraud risks are higher.

Benefits of Using Cardian SafeCard

- Enhanced Security

The biggest advantage is protection against unauthorized transactions and fraud.

- Peace of Mind

SafeCard users can travel, shop online, and make contactless payments without constantly worrying about theft.

- Prevents Identity Theft

By blocking RFID signals and requiring user authentication, SafeCard reduces the risk of stolen identity.

- Saves Money

Fraud can drain thousands of dollars before you even realize it. SafeCard helps avoid such losses.

- Easy to Use

It looks and feels like a regular card, so there’s no learning curve for users.

- Real-Time Control

With instant card lock/unlock features, you have complete authority over your transactions.

Who Should Use Cardian SafeCard?

Cardian SafeCard is beneficial for anyone who wants to protect their finances, but it is especially useful for:

- Frequent Travelers – More exposed to fraud in foreign locations.

- Online Shoppers – Regularly using cards for digital transactions.

- Senior Citizens – Often targeted by scammers.

- Business Professionals – Handling multiple cards and accounts.

- Families – Parents can protect their children’s bank cards.

Comparison: SafeCard vs. Traditional Cards

| Feature | Traditional Cards | Cardian SafeCard |

| RFID Protection | ❌ No | ✅ Yes |

| PIN/Biometric Security | Limited | Strong |

| Real-Time Control | ❌ No | ✅ Yes |

| App Connectivity | ❌ Rare | ✅ Yes |

| Anti-Skimming | ❌ No | ✅ Yes |

| Instant Lock/Unlock | ❌ No | ✅ Yes |

This table shows why Cardian SafeCard is miles ahead of traditional cards in terms of protection and flexibility.

Pros and Cons of Cardian SafeCard

Pros:

- High-level security features.

- Lightweight and easy to carry.

- Prevents both digital and physical fraud.

- Compatible with multiple types of cards.

- Ideal for frequent travelers.

Cons:

- May require charging (in some models).

- Slightly more expensive than regular cards.

- Availability may be limited in certain countries.

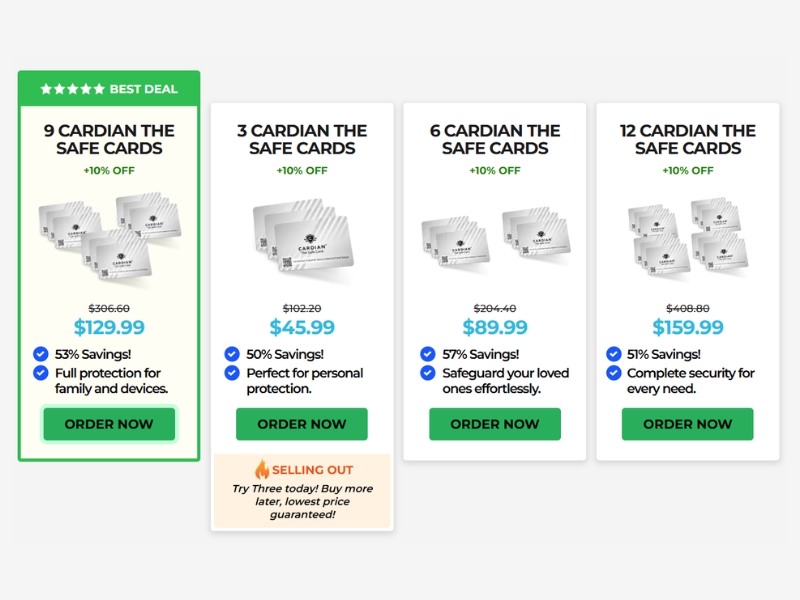

Pricing and Availability

Cardian SafeCard is usually sold through its official website and selected retail partners. Prices may vary depending on offers, bundles, and versions. Common packages include:

- 1 SafeCard Pack – Standard price.

- 2 SafeCard Pack – Discounted price.

- Family Pack (4 SafeCards) – Best value deal.

Some promotions also include free shipping or extended warranties. It’s generally recommended to buy from the official website to ensure authenticity and warranty coverage.

Customer Reviews & Feedback

Based on customer reports and online testimonials, most buyers are satisfied with Cardian SafeCard.

Positive Feedback:

- Many users claim they feel more secure while traveling.

- The RFID blocking feature is praised as extremely reliable.

- The instant lock/unlock function is a favorite among tech-savvy users.

Negative Feedback:

- Some customers find it slightly expensive.

- A few mentioned it takes time to get used to the extra step of authentication.

Overall, the majority of reviews lean toward positive, with most users recommending it to others.

Tips to Maximize SafeCard’s Use

- Register your SafeCard with the official app for better tracking.

- Keep it charged if it’s a digital version requiring power.

- Always enable PIN/Biometric security for maximum protection.

- Update the app regularly for security patches and new features.

- Avoid buying from third-party sellers to prevent counterfeit products.

The Future of Safe Payments

With products like Cardian SafeCard, the financial industry is moving toward a future where fraud-proof payments will become the norm. As contactless transactions continue to rise, having a digital guardian like SafeCard will likely become essential rather than optional.

Final Verdict: Is Cardian SafeCard Worth It?

Yes, Cardian SafeCard is worth considering if you want to secure your debit, credit, or bank cards from theft and fraud. While it might be slightly more expensive than traditional cards, the peace of mind and protection it offers outweighs the cost.

Whether you’re a frequent traveler, a heavy online shopper, or someone who simply values security, SafeCard ensures that your finances are safe from modern threats.

In a world where scams and frauds are evolving daily, relying solely on your bank’s security features is not enough. SafeCard adds another strong layer of protection, giving you total control over your financial security.