We live in a world where identity theft, online fraud, and unauthorized access to sensitive information are becoming alarmingly common. One careless move—like entering your card details on an unsafe website or losing your physical wallet—can expose you to huge financial and emotional stress. That’s where solutions like SafeCard come into play.

SafeCard claims to be a simple yet powerful way to secure your financial transactions, protect your data, and add a strong shield against fraud. But the real question is: does it actually deliver? Let’s break it down step by step in this detailed review.

What is SafeCard?

SafeCard is a digital and physical security solution designed to protect you from unauthorized use of your credit, debit, or ID cards. Think of it as a shield between you and cybercriminals. Depending on the version, SafeCard can function as:

-

A virtual card system that generates disposable card numbers for online purchases.

-

A protective RFID-blocking card that prevents thieves from skimming your data.

-

An all-in-one safety tool that combines convenience with modern encryption.

In short, SafeCard is marketed as a one-stop solution for both digital and physical card security.

Why Do People Need SafeCard?

You might wonder, “Do I really need another card or app to keep me safe?” Let’s consider the risks we face every day:

-

Data Breaches: Companies you trust may leak your data.

-

Skimming Devices: Thieves use hidden scanners to steal card details.

-

Online Shopping Risks: Entering your real card number everywhere increases exposure.

-

Lost Wallets: If someone finds your wallet, your information is immediately at risk.

SafeCard aims to reduce these risks by making your sensitive data unusable to criminals.

Key Features of SafeCard

Here’s what makes SafeCard stand out from traditional cards and ordinary fraud protection services:

1. RFID Blocking Technology

If you carry credit or debit cards with contactless payment, they’re vulnerable to wireless skimming. SafeCard uses RFID-blocking layers to stop scanners from stealing your information.

2. Disposable Virtual Cards

SafeCard generates unique card numbers for online purchases. Even if a hacker gets hold of one, it can’t be reused—keeping your real details hidden.

3. Encrypted Security

Unlike regular cards, SafeCard employs advanced data encryption that makes it nearly impossible for outsiders to access sensitive details.

4. Universal Compatibility

SafeCard works with most major banks and online payment systems, making it versatile and easy to integrate.

5. Simple & Portable

The physical version is slim, wallet-friendly, and requires no charging. It silently works in the background.

How Does SafeCard Work?

Think of SafeCard as a protective gatekeeper.

-

For physical use, you slip the RFID-blocking card into your wallet. Whenever someone tries to scan your card illegally, SafeCard blocks the signal.

-

For online shopping, SafeCard’s virtual card feature generates temporary numbers. This way, even if a website is compromised, hackers don’t get access to your real details.

It’s like having a bodyguard for your money, making sure no one touches it without permission.

Pros of SafeCard

✔️ Protects against wireless skimming

✔️ Adds an extra security layer for online shopping

✔️ Easy to use – no tech expertise required

✔️ Works with multiple payment systems

✔️ Affordable compared to fraud losses

Cons of SafeCard

❌ May require setup if using advanced features

❌ Physical card won’t help if your wallet is stolen

❌ Subscription fees may apply for premium versions

Who Should Use SafeCard?

SafeCard is useful for anyone, but it’s especially valuable if you:

-

Shop online frequently

-

Travel often (airports and crowded places are hotspots for skimming)

-

Use contactless payment cards

-

Worry about data privacy

-

Have been a victim of fraud before

If peace of mind is your priority, SafeCard can be a worthwhile investment.

Real Customer Experiences

To see if SafeCard actually works, let’s look at what customers are saying:

-

John P. from New York: “After my credit card was skimmed last year, I bought SafeCard. I’ve been traveling with it, and so far, I feel much safer.”

-

Amelia R. from London: “I use SafeCard’s virtual numbers for online shopping. It’s such a relief knowing my actual card isn’t exposed.”

-

David L. from Toronto: “It took me a little time to set up, but once I did, I realized how simple and effective it really is.”

Most users report greater peace of mind and fewer security issues.

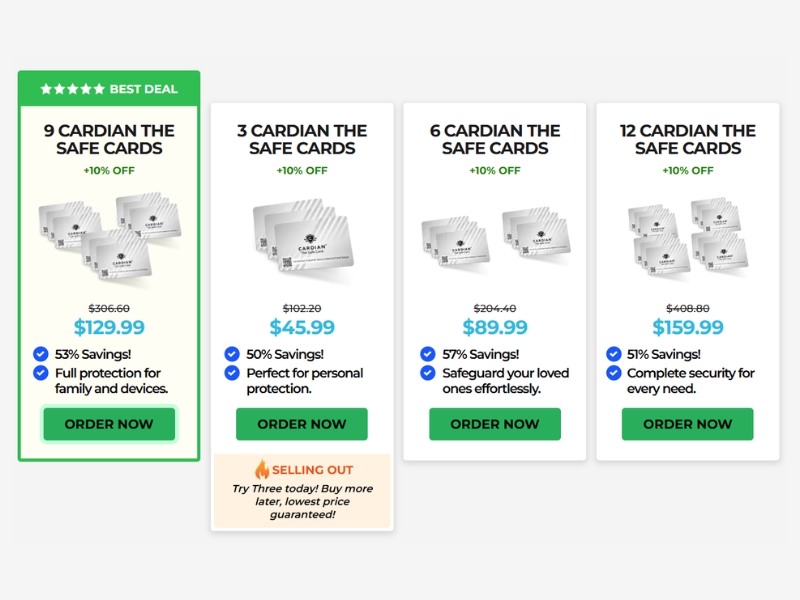

How Much Does SafeCard Cost?

Pricing often depends on whether you’re buying the physical RFID-blocking card or subscribing to the digital SafeCard service.

-

Physical SafeCard: One-time purchase, typically affordable.

-

Digital SafeCard Subscription: Monthly or yearly plans, depending on features like unlimited virtual cards or advanced fraud protection.

Compared to potential fraud losses, the price is relatively small.

Where to Buy SafeCard

The safest option is always the official SafeCard website. Buying directly ensures you get genuine protection and not counterfeit copies. Some versions may also be available through online marketplaces, but caution is advised.

Is SafeCard Really Worth It?

The short answer? Yes, if you value security.

In today’s digital age, protecting your financial identity is no longer optional. With its combination of RFID-blocking tech, disposable virtual numbers, and ease of use, SafeCard provides a practical layer of defense that most people overlook until it’s too late.

It’s not a magic bullet, but it reduces risks significantly—and that peace of mind is priceless.

Tips to Maximize SafeCard Benefits

-

Always carry the RFID-blocking version in your wallet.

-

Use virtual card numbers for every online purchase.

-

Combine SafeCard with strong passwords and 2FA (two-factor authentication).

-

Regularly monitor your bank statements for suspicious activity.

-

Avoid saving real card numbers on shopping sites.

Final Verdict: Should You Buy SafeCard?

If you’re serious about protecting your money, privacy, and identity, SafeCard is definitely worth considering. It’s simple, effective, and affordable. While no product can guarantee 100% protection, SafeCard closes many of the gaps that criminals exploit.

Think of it this way: you lock your doors at night even though burglaries aren’t guaranteed. SafeCard is like locking the digital doors to your money.

Conclusion

SafeCard offers a powerful solution for anyone concerned about modern fraud and identity theft. From its RFID-blocking protection to virtual disposable cards, it combines convenience with cutting-edge security.

Whether you shop online, travel frequently, or simply want peace of mind, SafeCard is an investment that can save you a lot of trouble down the road.

FAQs – SafeCard Reviews

Q1. Does SafeCard really block RFID scanners?

Yes. The physical SafeCard uses special materials that block wireless signals, preventing thieves from skimming your details.

Q2. Can SafeCard replace my regular bank card?

No. SafeCard works alongside your bank cards as an extra layer of protection, not as a replacement.

Q3. Is SafeCard difficult to set up?

Not at all. The RFID version requires no setup. The digital SafeCard app might take a few minutes to configure, but it’s beginner-friendly.

Q4. Is SafeCard available worldwide?

Yes, SafeCard can be purchased online and shipped to many countries, though availability may vary by region.

Q5. Is SafeCard worth the money?

Considering the rising cases of fraud, many users find the price small compared to the potential losses it helps prevent.