In today’s fast-paced digital world, financial security and personal privacy have become more important than ever before. With the rise of online transactions, mobile banking, and contactless payment systems, the need to safeguard sensitive information has reached a critical point. Cybercriminals are constantly finding new ways to exploit security vulnerabilities, making individuals more vulnerable to fraud, identity theft, and unauthorized financial activities.

This is where SafeCard comes into play. Designed to provide a strong layer of protection for users, SafeCard offers innovative solutions that help prevent unauthorized access, safeguard payment details, and ensure peace of mind for cardholders worldwide. Whether you’re worried about digital pickpocketing, online fraud, or identity theft, SafeCard positions itself as a reliable shield against such threats.

The Growing Need for SafeCard

Before diving into the specifics, it’s essential to understand why SafeCard is relevant in today’s society. A few facts highlight the increasing risks faced by individuals globally:

-

Rising Card Fraud Cases

Credit and debit card fraud remains one of the most common financial crimes. According to global reports, billions are lost every year due to skimming, phishing, and data breaches. -

Contactless Payment Risks

With tap-to-pay options becoming the norm, it has also opened the door for “digital thieves” who use RFID (Radio Frequency Identification) and NFC (Near-Field Communication) skimming devices to capture card data without physical contact. -

Identity Theft Growth

Hackers are no longer satisfied with just stealing money—they also target personal details that can be used to open new accounts, apply for loans, or commit fraud in someone else’s name. -

Online Security Loopholes

As more people shop online, weak passwords, unsecured networks, and phishing scams make it easier for criminals to gain access to sensitive information.

Given these growing threats, tools like SafeCard have become essential for individuals who want 24/7 financial safety.

What is SafeCard?

SafeCard is a modern security and protection solution designed to shield your personal and financial information from potential theft or misuse. Depending on the product variant, SafeCard may include:

-

RFID-blocking card protectors – Prevents unauthorized scanning of contactless credit/debit cards.

-

Digital security software – Monitors online transactions, detects fraud, and alerts users.

-

Identity protection services – Guards personal data from hackers, phishing attempts, and data breaches.

-

All-in-one safety solutions – Combines both physical and digital protection into a single product.

The main aim of SafeCard is to give individuals peace of mind by knowing that their financial and personal data is always secure, whether they’re shopping online, using mobile banking, or simply carrying their cards in a wallet.

Key Features of SafeCard

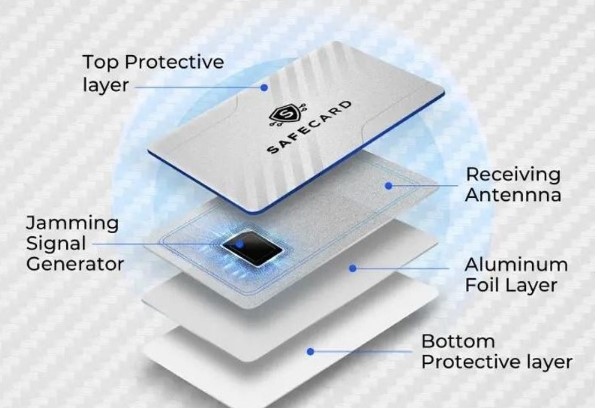

1. RFID & NFC Blocking

One of the most popular features of SafeCard is its ability to block wireless skimming attacks. Thieves with RFID scanners can steal your card data from a short distance—without you ever noticing. SafeCard’s built-in blocking technology creates a protective shield, making it impossible for scanners to read your card’s data.

2. Fraud Monitoring Alerts

Some versions of SafeCard are integrated with fraud detection services. These systems monitor your online transactions in real-time and send alerts in case of suspicious activity, ensuring you can act before major damage is done.

3. Identity Theft Protection

SafeCard also offers protection for personal information such as social security numbers, driver’s licenses, and even medical records. By scanning the dark web and monitoring data breaches, it ensures your identity remains safe.

4. User-Friendly Design

SafeCard is designed to be lightweight, slim, and easy to use. For physical card protectors, it fits into any wallet without adding bulk. For digital services, the dashboard is typically intuitive, with easy-to-understand alerts and reports.

5. Data Encryption

SafeCard solutions often use advanced encryption technology to safeguard online payments. This makes it extremely difficult for hackers to intercept or misuse your sensitive data.

6. Global Coverage

Unlike traditional protection limited to one bank or region, SafeCard works universally, offering protection whether you’re at home, traveling, or shopping online internationally.

How Does SafeCard Work?

SafeCard functions differently depending on the version you choose:

-

For RFID-blocking cards or wallets: It emits a protective electromagnetic field that prevents external scanners from accessing the microchip embedded in contactless cards. Essentially, it blocks all unauthorized radio signals.

-

For digital protection services: It uses advanced AI-driven algorithms to detect unusual transaction patterns, flag suspicious activities, and protect users in real time.

-

For identity protection: It constantly scans the dark web and breach databases for traces of your personal information. If your data appears, SafeCard sends you alerts and provides steps to prevent misuse.

Benefits of Using SafeCard

-

Peace of Mind – Knowing your finances and identity are secure helps you focus on daily life without constant worry.

-

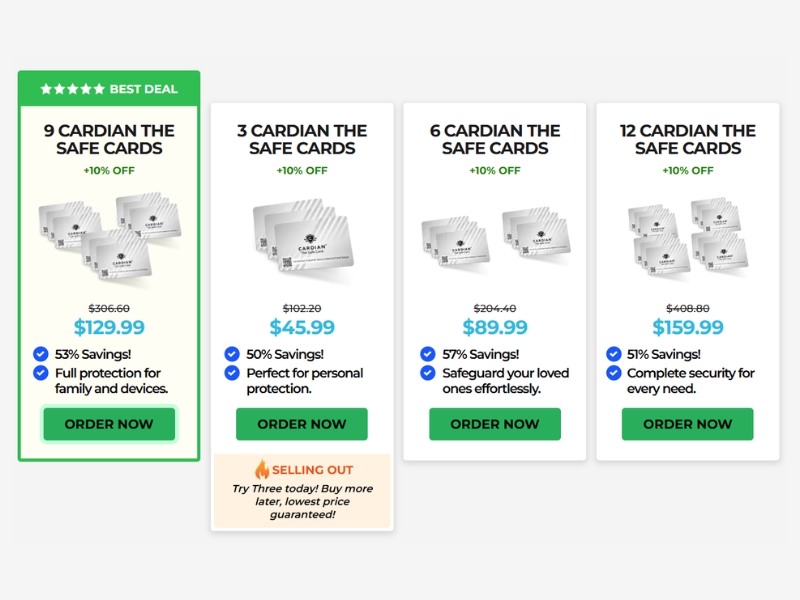

Affordable Protection – Compared to the costs of fraud recovery, SafeCard is a cost-effective solution.

-

24/7 Security – Works around the clock to protect against threats, even when you’re unaware of them.

-

Travel-Friendly – Essential for travelers who often use ATMs, public Wi-Fi, or shop abroad.

-

Prevents Financial Loss – Stops unauthorized access before criminals can drain accounts.

-

Identity Preservation – Helps prevent long-term damage caused by identity theft.

Who Should Use SafeCard?

SafeCard isn’t just for the tech-savvy or wealthy. It’s for anyone who values security. Key groups include:

-

Frequent Travelers – Airports, hotels, and international destinations are hotspots for data theft.

-

Online Shoppers – Regular use of e-commerce platforms increases fraud risk.

-

Contactless Card Users – If you rely on tap-to-pay, RFID-blocking protection is a must.

-

Business Professionals – Carrying sensitive corporate information or multiple credit cards needs extra security.

-

Elderly Individuals – Often targeted by scammers, SafeCard adds a vital shield of protection.

Comparing SafeCard with Other Security Options

Unlike traditional wallets, password managers, or bank alerts, SafeCard offers multi-layered protection that covers both physical and digital vulnerabilities. Some banks offer fraud alerts, but they don’t always prevent unauthorized transactions. Similarly, antivirus software secures your devices but doesn’t block RFID skimming. SafeCard bridges these gaps by offering a comprehensive solution.

Real-World Scenarios Where SafeCard Helps

-

Airport Check-In: A digital pickpocket tries to scan your contactless card—SafeCard blocks it instantly.

-

Online Shopping: You receive a fraud alert about suspicious charges and stop them before they go through.

-

Data Breach Notification: SafeCard detects your email and password in a breach database and alerts you to change credentials.

-

Travel Abroad: While using hotel Wi-Fi, SafeCard encrypts your transaction details, keeping them safe from hackers.

Pros and Cons of SafeCard

✅ Pros:

-

Comprehensive protection (physical + digital)

-

Lightweight and easy to carry

-

Affordable compared to potential fraud losses

-

Real-time alerts and monitoring

-

Works globally

❌ Cons:

-

Some versions may require subscription fees

-

Not all services cover every type of fraud

-

Users must remain cautious—no solution is 100% foolproof

Tips for Maximizing SafeCard Protection

-

Pair It with Strong Passwords – SafeCard adds security, but always use unique, strong passwords.

-

Stay Aware of Scams – Don’t click suspicious links or share personal info online.

-

Regularly Check Bank Statements – Even with SafeCard, personal vigilance is important.

-

Keep Software Updated – If using SafeCard’s digital app, update regularly for better protection.

-

Use Secure Networks – Avoid public Wi-Fi for financial transactions unless SafeCard encryption is active.

Why People Are Choosing SafeCard

More individuals are turning to SafeCard because it combines simplicity with effectiveness. Unlike complex cybersecurity systems, SafeCard is designed for everyday use without technical knowledge. Its affordability also makes it accessible for the general public, not just corporations or high-net-worth individuals.

Final Thoughts – Is SafeCard Worth It?

In an age where financial fraud, identity theft, and cybercrime are on the rise, relying solely on banks or personal vigilance isn’t enough. SafeCard steps in as a reliable, cost-effective, and user-friendly solution for anyone looking to protect their sensitive data.

Whether you’re traveling abroad, shopping online, or simply using tap-to-pay at your local store, SafeCard ensures that your personal and financial information stays safe from prying eyes. While no tool can offer 100% protection, SafeCard dramatically reduces risks and provides the peace of mind that everyone deserves in today’s digital age.

For individuals and families alike, investing in SafeCard is not just about protection—it’s about taking control of your financial security in an unpredictable world.